Hong Kong Withholding Tax: What You Need to Know

Part 1:

https://www.behance.net/gallery/133533181/Hong-Kong-Withholding-Tax-What-You-Need-to-Know

3. Which types of payments are subject to withholding tax in Hong Kong?

Not all payments to non-resident companies shall be subject to withholding tax in Hong Kong. Typically, Hong Kong imposes no tax on dividends and interest. Typical payments that would go with Hong Kong withholding tax comprise:

- Royalties made non-resident individual or company

- Charges paid to non-resident sportsmen or entertainers

3.1. Royalty payments

Royalty payments are paid for the right to use the intellectual property of non-residents inside and outside of Hong Kong. Withholding taxes on royal payments can vary according to whether the non-resident is related to a Hong Kong entity or not.

Examples of royalties or license fees are as the followings:

- Payments for the exhibition or use in Hong Kong of cinematography or television film or tape, any sound recording, or any advertising material connected with such film, tape, or recording;

- Fees for the use/usage right in Hong Kong, of any patent, design, trademark, copyright material, layout-design (topography) of an integrated circuit, performer’s right, plant variety right, secret process or formula, or other property or right of a similar nature;

- Payments for imparting knowledge directly, or indirectly connected with the use in Hong Kong of any such patent, design, and above-mentioned categories.

3.2. Entertainer or sportsman payments

Non-resident entertainers or sportsmen who get income from the performance in Hong Kong are subject to withholding tax in the country as well.

The IRO defined “entertainer or sportsman” as a person (other than a corporation) who gives performances whether alone or with other persons in his character as an entertainer or sportsman in any kind of entertainment or sport.

NOTE

Forms of said performances can be:

- Performing activity (recorded or live); or

- Performing activity can be observed or heard by the public whether for making income or not.

Examples of entertainer or sportsman payments, which will then be the target of Hong Kong withholding tax:

- Payments for any appearance of the entertainers or sportsmen by way of or in connection with the promotion of any commercial occasion or event;

- Payments for any participation by the entertainers or sportsmen in or for sound recording, films, videos, radio, television or other similar transmissions (whether live or recorded).

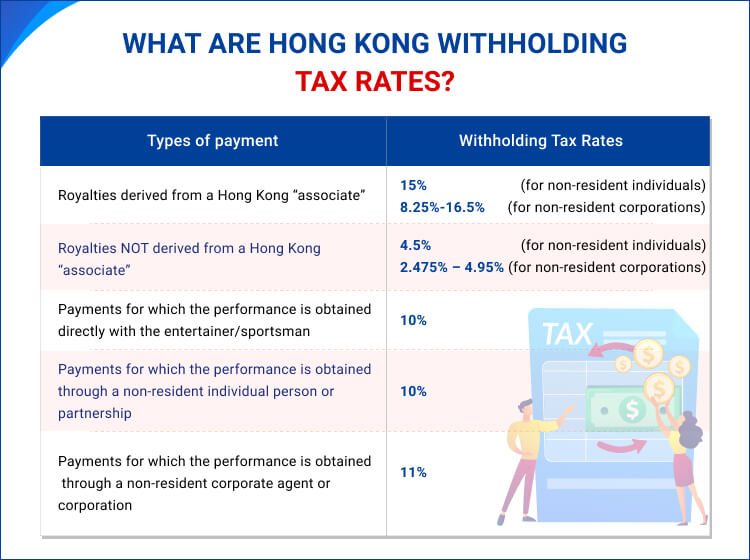

4. What are rates for Hong Kong withholding taxpayers?

Note that withholding tax can be different, depending on the type of payment made to non-residents and where that payment comes from.

The below table helps you clarify the WHT rates on each type of payment:

* Under Inland Revenue Ordinance (amended in 2004) of Hong Kong, “associates” of a Hong Kong entity refers to the following entities:

If the Hong Kong entity is “a natural person”

- A person’s relative

- A person’s partner and any relative of that partner;

- A partnership in which a person is a partner;

- A corporation controlled by the person, a partner, or a partnership in which the person is a partner;

- Any director or principal officer of any such corporation listed above.

If the Hong Kong entity is “a corporation”

- A corporate company

- A corporation over which the Hong Kong entity has control

- A corporation that has control over the Hong Kong entity; or

- A corporation under the same control as the Hong Kong entity

- A person who controls a corporate company and any partner of that person, and where either that person is a natural person, any relative of that person;

- A director or principal officer of that company or corporate company of that company; and any relative of any such director or officer;

- Any partner of the company and, where such partner is a natural person, any relative of such partner.

If the Hong Kong entity is “a partnership”

-

- Any partner of the partnership, and where such partner is a partnership, any relative of that partner;

- A corporation controlled by the partnership or by any partner thereof or, where such a partner is a natural person, any relative of such partner;

- A corporation of which any partner is a director or principal officer;

- Any director or principal officer of a corporation.

Regarding WHT for entertainers or sportsperson, WHT payment depends on whom the non-resident entertainers or sportsmen made their agreement directly with (individuals or through a corporate agent or a corporation).

5. How to reduce Hong Kong withholding tax

Have you heard of Hong Kong double taxation agreements?

Those can help you avoid the double taxation of income, as well as adjust the tax rights between Hong Kong and other jurisdictions.

Hong Kong has concluded over 40 Comprehensive DTAs (Double Tax Agreements). Under such agreements, residents of participating countries can enjoy tax relief and reduction for tax liability levied on the same type of income.

So, depending on a case-by-case basis, you can have a chance to enjoy a foreign tax deduction on specified interest and gains. This might happen if you provide sufficient proof that such tax has been paid elsewhere in a place outside HK with which Hong Kong have made DTA.

6. Final thoughts

- Withheld tax amount is applicable to 2 types of payment: on royalties/license fees, and payments paid to entertainers/sportsmen.

- Taxpayers can make use of comprehensive DTAs that Hong Kong has signed with many other countries to reduce Hong Kong WHT.

We hope this article gives you a better understanding of Hong Kong withholding tax.